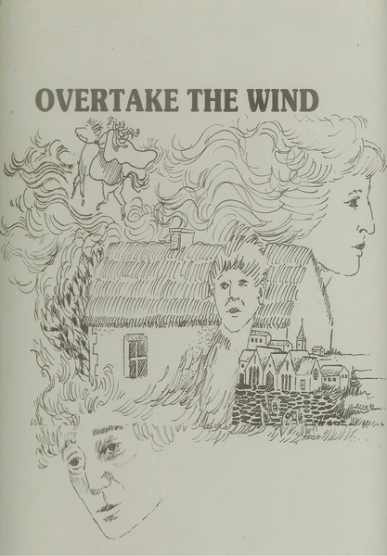

The "Irish Troubles" of Northern Ireland in the early 1980s:

Billy, 10, sees his Mother blown to bits by an Irish Republican Army (IRA) bomb at his Protestant Father's factory. He runs out of Londonderry, jumping a lorry (a truck) and ends up in the Irish speaking Gaeltacht where he finds solace with a surrogate Mother, Naomi, a Pooka, Barnaby, a donkey-appearing spirit that protects him and a lyrical fairy tale that prophesizes Billy's tragic death when Billy protects his adopted Father, Benji, a reluctant IRA assassin who is wanted by all factions of the conflict.

Currently casting Principal roles of Naomi and Benji from fine actors and selecting the Director with a similar stature.

As soon as we have cast principal roles and/or director, we have an introduction to one of the world's highest level financier/producers, to whom we would present the screenplay and the participation of the fine director and actors.